sacramento property tax rate

What is Sacramento tax rate. This is the total of state county and city sales tax rates.

Under Proposition 13 the property tax rate is fixed at 1 of assessed value plus any assessment bond approved by popular vote.

. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. California Property Tax Rates County Median Home Value Average Effective Property Tax Rate Riverside 304500 097 Sacramento 299900 084 San Benito 459700 082 San Bernardino 280200 083. The median property tax on a 32420000 house is 220456 in Sacramento County.

St Room 1710 Sacramento CA 95814. Our Mission - We provide equitable timely and accurate property tax assessments and information. 875 Sacramento California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento California is 875.

You may also pay by phone 877 590-0714. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Box 508 Sacramento CA 95812-0508.

For paper checks use the mailing address PO. There is no fee for paying via online check e-check. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. April 10 Last day to pay second installment of secured property taxes without penalty. Many records requ ired to be kept or prepared by the Assessor are considered public documents and are available for viewing at our self-service public information computers.

View the public records page for more information. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. The California sales tax rate is currently 6.

The County sales tax rate is 025. See detailed property tax information from the sample report for 2526 H St Sacramento County CA. The online and phone payment systems will be taken offline after 5.

Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Property information and maps are available for review using the Parcel Viewer Application. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

Annual tax bills may also include other items such as special assessments. Tax Collection and Licensing. The Yolo County Tax Collectors Office will be open until 500 pm.

As a result of various assessment bonds property tax rates in Sacramento County average roughly 11 countywide. Learn more About Us. Property taxes are collected by the County but governed by California state law.

Sacramento County Finance. The Auditor-Controller computes the amount of tax due by multiplying the taxable value of the property by the applicable tax rate the tax rate is equal to 1 percent plus bonded debt for the location of the assessed property within the County to determine the amount of tax. If you are not sure of the exact amount of secured property taxes due tax bill amounts are available online.

For a current payoff amount for Secured prior year delinquent taxes please call the 24 hour Automated. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value. Tax Rates And Direct Levies.

For payment by phone call 844 430-2823. What is California property tax rate. You may pay your property taxes by credit or debit card a 234 convenience fee will be added or e-check no charge online.

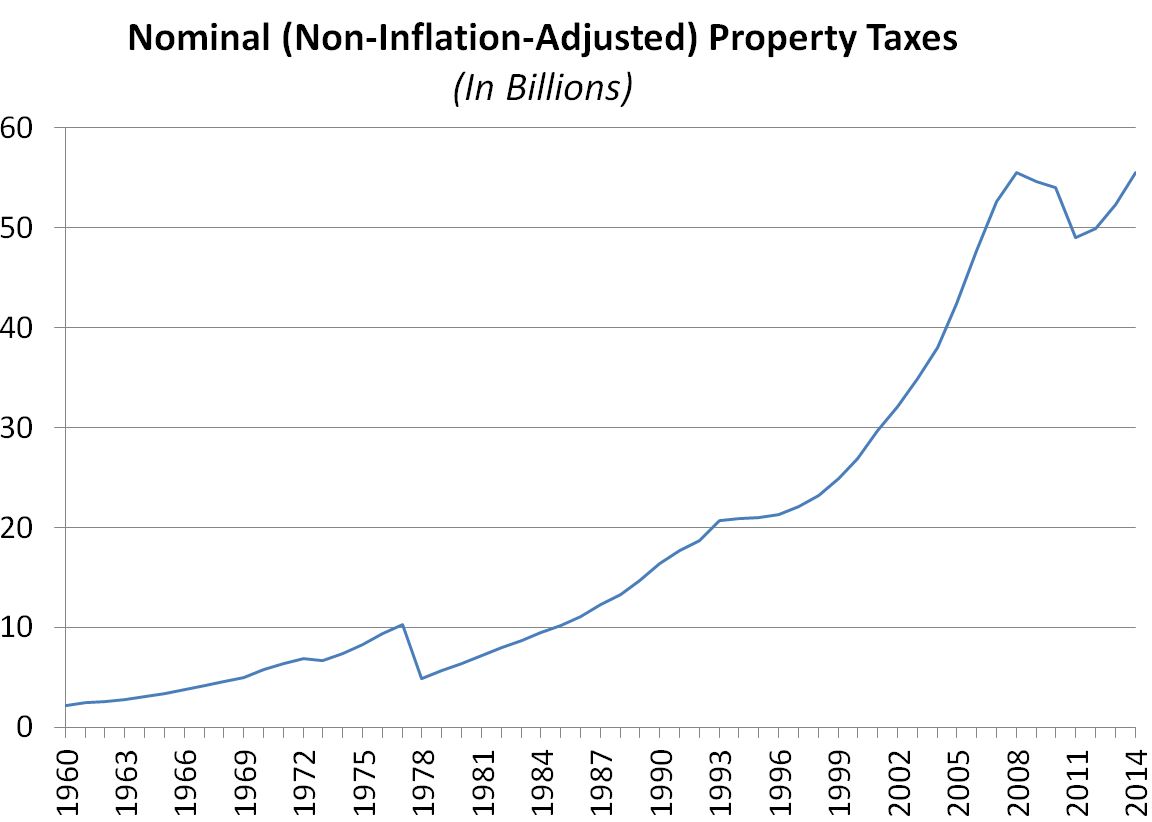

Proposition 13 enacted in 1978 forms the basis for the current property tax laws. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Business property owners must file a statement each year detailing the cost of all supplies machinery equipment leasehold improvements fixtures and land owned at each location within Sacramento County.

The median property tax on a 32420000 house is 239908 in California. To look a parcel up through e-PropTax Sacramento Countys Online Property Tax Information you will need the 14 digit parcel number. The median property tax on a 32420000 house is 340410 in the United States.

On Monday April 11 2022. Secured real property taxes are an ad-valorem value based property tax that is the liability of the person or entity assessed for the tax. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of 29.

The Unsecured Personal Property Tax Unit is available to assist you by phone at 916 874-7833 via email at TaxPpropsaccountygov or at our public counter at 700 H. Sacramento county tax rate area reference by primary tax rate area. 3636 American River Drive Suite 200 Map Sacramento CA 95864.

View the E-Prop-Tax page for more information. 916-875-0700 or e-mail. To pay online visit the Online Property Tax Bill Information System.

Secured Property Taxes Treasurer Tax Collector

Proposition 13 Report More Data On California Property Taxes Econtax Blog

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

332 Blackbird Ln Sacramento Ca 95831 Black Bird Real Estate Professionals House Prices

Secured Property Taxes Treasurer Tax Collector

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Pin On Articles On Politics Religion

Understanding California S Property Taxes

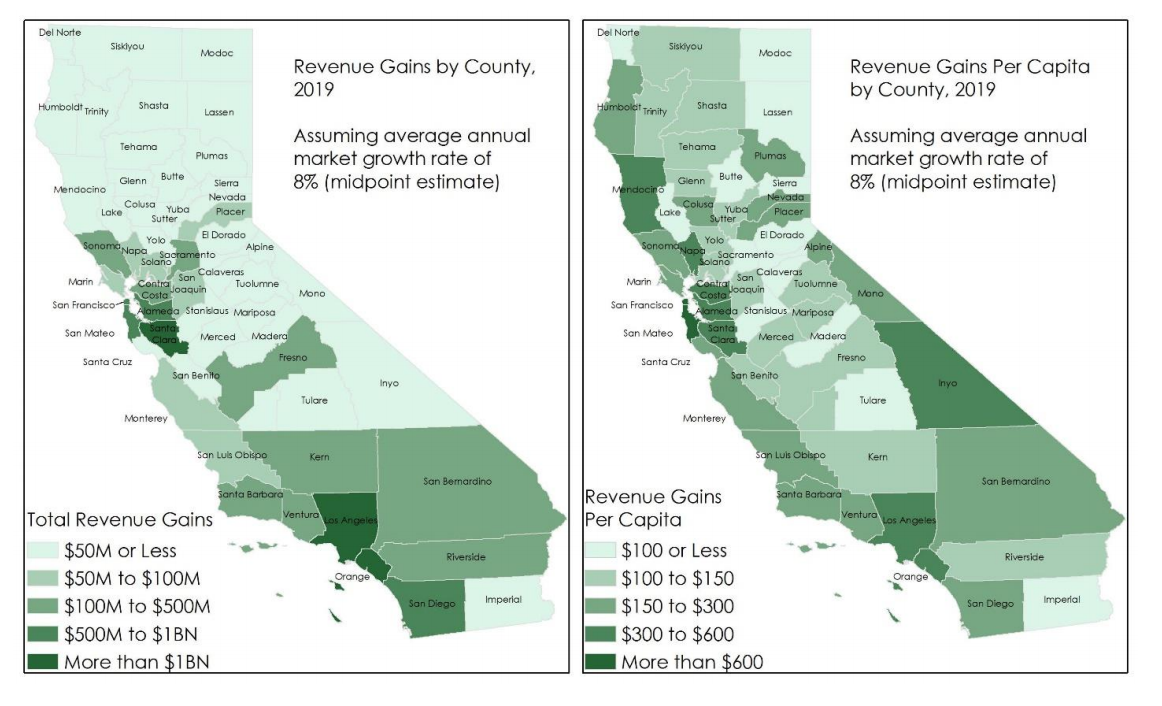

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Riverside County Ca Property Tax Calculator Smartasset

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Property Tax By County Property Tax Calculator Rethority

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Those Who Have A Better Grasp Of Tax Technicalities And Opportunities For Economic Growth Will Always View Estat Estate Planning Florida Real Estate Estate Tax

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

If You Are Renting A Home At 1600 A Month In Sacramento You Could Break Even On That Amount In Only 1 Year And Rent Vs Buy Buying A Condo Las

Property Taxes Department Of Tax And Collections County Of Santa Clara