tax shelter meaning in real estate

AL Alabama Real Estate Exam Prep. The failure to report a tax shelter identification number has a penalty of 250.

Tax Shelter Definition Examples Using Deductions

Pick a state where youre taking your Real Estate Exam.

. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments. Amelia JosephsonDec 11 2019. A financial arrangement by which investments can be made without paying tax 2.

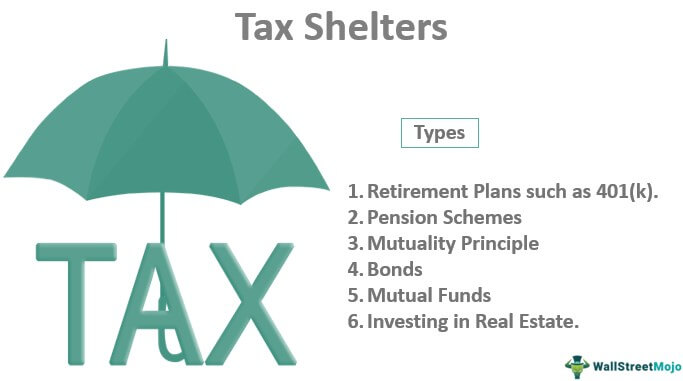

Tax shelters are ways individuals and corporations reduce their tax liability. Tax shelters work by reducing your taxable income thereby reducing your taxes. Popular tax shelters include real estate projects and gas and oil drilling ventures.

An establishment that houses and feeds strays or unwanted animals. There are many different types and ways to do this but investment is most common. Shelters range from employer-sponsored 401 k programs to overseas bank accounts.

A tax shelter is an investment that generates either tax-deferred or tax-exempt income. AZ Arizona Real Estate Exam Prep. Traditional tax shelters have included investments in real estate.

In other words it is a type of legal strategy with the help of which an individual can. A tax shelter is a legal way of investing in certain plans or schemes that reduce the overall taxable income of the taxpayers and therefore save the taxes that are paid to the state or. A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man.

An investment that produces relatively large current deductions that can be used to offset other taxable income. Many people think of tax shelters. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money.

AR Arkansas Real Estate. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. AK Alaska Real Estate Exam Prep.

What is a Tax Shelter. Tax shelters are legal and can range from investments or investment accounts that provide favorable tax treatment to activities or transactions that lower taxable income through deduc. When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have.

A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. More Real Estate Definitons.

The methodology can vary. One can do this through. Something that provides protection.

To be a tax shelter the investment has to lose money. A tax shelter is a legal method of reducing. A tax shelter is any method of reducing the taxes you owe legally.

Delving into this a little further a tax shelter isnt too far off the. A number of real estate tax shelter exist. If you carry a mortgage on your rental property you can deduct mortgage interest paid come tax time.

A tax shelter takes advantage of various aspects of the tax. 448a3 prohibition defines tax shelter at. What is a Tax Shelter.

There wont always be significant real estate. A tax shelter is more or less like a financial vehicle through which taxpayers can safeguard their money. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income.

The phrase tax shelter is. A tax shelter is a vehicle used by individuals or organizations to minimize or decrease their taxable incomes and therefore tax liabilities. It is a legal way for individuals to stash their money and.

There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. Popular tax shelters include real estate projects and gas and oil drilling.

Preparing Your Community For Opportunity Zones Opportunity Capital Gain Track Investments

What Is The Biggest Tax Shelter For Most Taxpayers

How The Broad Definition Of Tax Shelter Affects Business Interest Deductions And Cash Method Accounting Under New Tax Law Article Refinancing Mortgage Mortgage Letter Gifts

How Is A Tax Shelter Calculated In Real Estate

Tax Shelters For High W 2 Income Every Doctor Must Read This

Tax Shelters Definition Types Examples Of Tax Shelter

Real Estate Blog Mortgage Rates Today 30 Year Mortgage 10 Year Mortgage

Need Retirement Inspiration Delaware S Tax Benefits Are Sure To Impress Learn More At Noble S Pond Tax Gas Tax Delaware

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

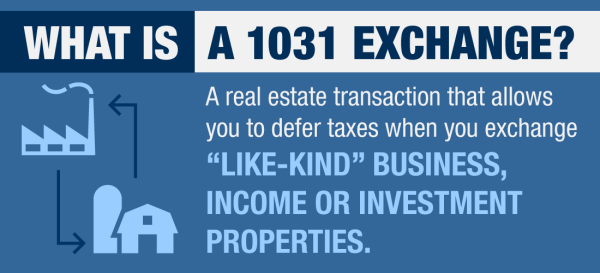

Are You Eligible For A 1031 Exchange

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

9 Legal Tax Shelters To Protect Your Money Gobankingrates

Income Tax Explained Earning I Want To Buy A House Income Tax Income Tax

What Is A Tax Shelter And How Does It Work

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

Str 01 How The Short Term Rental Loophole Can Save You Thousands In Taxes

Libor Transition Creates Possible Disconnect Exposure How To Be Outgoing Real Estate Tips Newport Beach Homes